What Do Individuals Use to Transfer Their Risk of Loss to a Larger Group

What is Hazard Transfer?

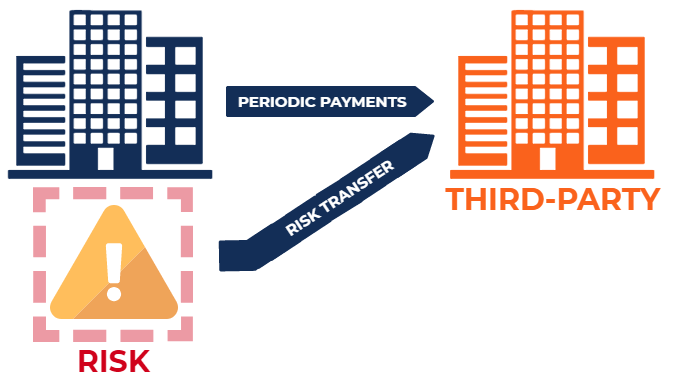

Take a chance transfer refers to a gamble management technique in which risk is transferred to a third political party. In other words, hazard transfer involves one party assuming the liabilities of some other party. Purchasing insurance is a common example of transferring take chances from an private or entity to an insurance company.

How Information technology Works

Chance transfer is a common run a risk management technique where the potential loss from an agin result faced by an individual or entity is shifted to a tertiary party. To recoup the 3rd political party for bearing the hazard, the private or entity volition by and large provide the third party with periodic payments.

The most common case of hazard transfer is insurance. When an individual or entity purchases insurance, they are insuring confronting financial risks. For example, an individual who purchases car insurance is acquiring financial protection against physical damage or actual damage that can issue from traffic incidents.

As such, the individual is shifting the take chances of having to incur meaning financial losses from a traffic incident to an insurance company . In commutation for bearing such risks, the insurance visitor will typically require periodic payments from the individual.

Methods of Risk Transfer

There are 2 common methods of transferring risk:

1. Insurance policy

As outlined above, purchasing insurance is a common method of transferring risk. When an private or entity is purchasing insurance, they are shifting financial risks to the insurance company. Insurance companies typically charge a fee – an insurance premium – for accepting such risks.

ii. Indemnification clause in contracts

Contracts can also be used to help an individual or entity transfer chance. Contracts tin can include an indemnification clause – a clause that ensures potential losses will be compensated by the opposing political party. In simplest terms, an indemnification clause is a clause in which the parties involved in the contract commit to compensating each other for any harm, liability, or loss arising out of the contract.

For case, consider a client that signs a contract with an indemnification clause. The indemnification clause states that the contract author volition indemnify the client against copyright claims. As such, if the client receives a copyright claim, the contract writer would (1) be obliged to encompass the costs related to defending against the copyright claim, and (2) be responsible for copyright claim damages if the client is establish liable for copyright infringement.

Risk Transfer by Insurance Companies

Although risk is commonly transferred from individuals and entities to insurance companies, the insurers are also able to transfer risk. This is washed through an insurance policy with reinsurance companies. Reinsurance companies are companies that provide insurance to insurance firms.

Similar to how individuals or entities buy insurance from insurance companies, insurance companies tin can shift chance by purchasing insurance from reinsurance companies. In commutation for taking on this take a chance, reinsurance companies charge the insurance companies an insurance premium.

Risk Transfer vs. Risk Shifting

Hazard transfer is usually dislocated with chance shifting. To reiterate, adventure transfer is passing on ("transferring") risk to a tertiary political party. On the other hand, risk shifting involves changing ("shifting") the distribution of risky outcomes rather than passing on the take a chance to a third party.

For case, an insurance policy is a method of adventure transfer. Purchasing derivative contracts is a method of risk shifting.

Boosted Resources

CFI is the official provider of the global Financial Modeling & Valuation Analyst (FMVA)™ certification plan, designed to help anyone become a world-class financial analyst. To go along learning and advancing your career, the boosted CFI resources beneath will be useful:

- Actuary

- Commercial Insurance Banker

- Safe Harbor

- Subrogation

Source: https://corporatefinanceinstitute.com/resources/knowledge/strategy/risk-transfer/

0 Response to "What Do Individuals Use to Transfer Their Risk of Loss to a Larger Group"

Postar um comentário